Now that we got that out of the way we can get into the fun stuff. I’m going to break this up into 3 parts, electric busses, electric solutions, and what I believe to be most impressive, their battery solutions/partnerships.

Electric buses:

Proterra Transit

-Currently this is their main source of revenue

-Over 130 customers in 43 states so far!

-Some of the most notable being the National Park Service, colleges such as of this week Harvard, Duke(go blue devils!), and Georgia. Also, Jill, and airports such as SFO and JFK.

To see the full list:https://www.proterra.com/company/our-customers/

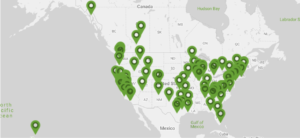

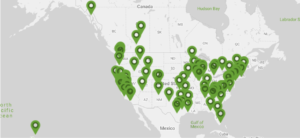

This map shows the location of their customers:

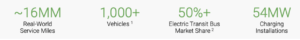

As of right now they have:

And yes you read that right, over 50 percent electric transit bus market share.

-Proterra is also breaking boundaries in the pricing of their buses. They offer an option to pay the battery off overtime like gasoline. This gives particularly transit departments a better way to fit it into their budget.

Electric Solutions:

-In addition to their busses Proterra also provides charging stations.

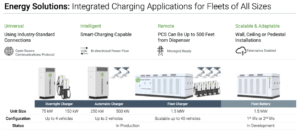

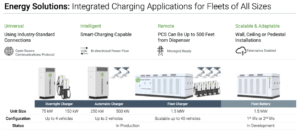

Here is how their charging stations work:

Customers are incentivized to buy these charging station because of Proterra’s Cloud-based data-system, Apex Software. This helps gives users a centralized singular area to check the overall statistics of their fleet.

-Proterra has installed over 50 Megawatts of these charging stations nationwide.

Batteries/Partnerships:

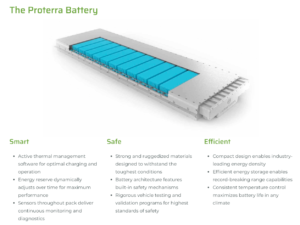

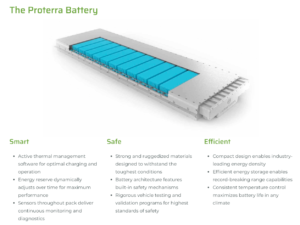

Proterra currently has some of the best batteries in the game. Their batteries have 330 miles for their buses, and can be used across a number of applications. This is what I think their insane growth in the future will come from.

Their partnerships with batteries(Proterra Powered) include:

-Daimler’s Thomas Built Buses. Daimler has 50 percent market share in the school bus market. Daimler worth 85b! Not only are they working with Proterra, but have a 200m investment in them. This gives Proterra access into this market and an advantage over competitors like Lion Electric($NGA)

-Komatsu(worth 23b) for their electric excavator. This gives Proterra access to another completely different market and makes them now competitors with the 107b CAT.

-Electric Last Mile Solutions. Going public through FIII. Company worth 1.8b, and this helps Proterra gain traction in the massive delivery van market.

-Vanhool, for their coach bus. They have an estimated 2b in annual revenue. Legitimizing Proterra in the electric luxury bus market as well.

–Bustech for busses for the Australian climate. Overall, bettering their buses.

– Freightliner Custom Chassis Corporation (FCCC) to develop the MT50e, a new all-electric delivery truck chassis. This gives Proterra another access to revenue.

Conclusion:

This company has so much going for it, they should be worth at least 15b($70). Market doesn’t understand the potential of all these battery partnerships. This is a great opportunity to take advantage of. Good luck to all!

Sources:

https://www.proterra.com/

https://www.proterra.com/wp-content/uploads/2021/01/ACTC-Proterra-Investor-Presentation.pdf

Disclaimer: The stocks mentioned in my newsletter and blog are not intended to be a list of buy recommendations but rather some ideas for your watchlist. Perhaps they end up in your own portfolio after you conduct your own research and due diligence. Some of the stocks mentioned in my newsletters have smaller market capitalizations and therefore can be more volatile. I always encourage everyone to do their own research and due diligence before buying any stocks mentioned in my newsletters. Please manage your portfolio and position sizing in accordance with your own risk tolerance and investment objectives.